Financial Advisors You Can Trust

Our Schaumburg, IL financial advisor is here to help you make decisions about what you should do with your money, which can include investing or other courses of action. Whether you have accrued significant debt or are looking to jumpstart a small business, our financial advisor can educate you about the steps required to help you organize your finances. We will give you the education, tools and insights into how to set up your financial plan, so you have a strong foundation. You can rely on our trusted team at Bott & Associates, Ltd. to give you clear direction and support so you can make informed financial decisions and accomplish your goals. Call us today to schedule your free consultation.

Table of Contents

- Financial Advisors You Can Trust

- Components Of A Financial Plan

- Important Illinois Financial Planning Laws To Consider

- Infographic

- Financial Planning Statistics

- FAQs

- Contact Our Team Today

Preserving Your Wealth With Custom Strategies

At Bott and Associates LTD, we have over 20 years of experience protecting clients’ wealth and ensuring that even if their client goes through a hard time and potentially loses a loved one, Bott and Associates LTD is prepared to work with them.

We are prepared to recognize and handle pretty much any complex issue that you bring to them regarding your wealth. Our advisors are also attorneys who handle probate, trust administration, estate planning cases. We know how to identify important scenarios of potential pitfalls that your family might endure after you are gone.

There are many approaches you can choose from when it comes to financial planning. The role of a financial advisor is an important one, and they can provide assistance in many areas of finance in both your personal and professional life. Many people assume financial advisors only help you with large-scale investments or business strategies, but they can help you with both general and specific topics. After obtaining a clear understanding of your values, needs, and goals, we can develop a plan to help you achieve them.

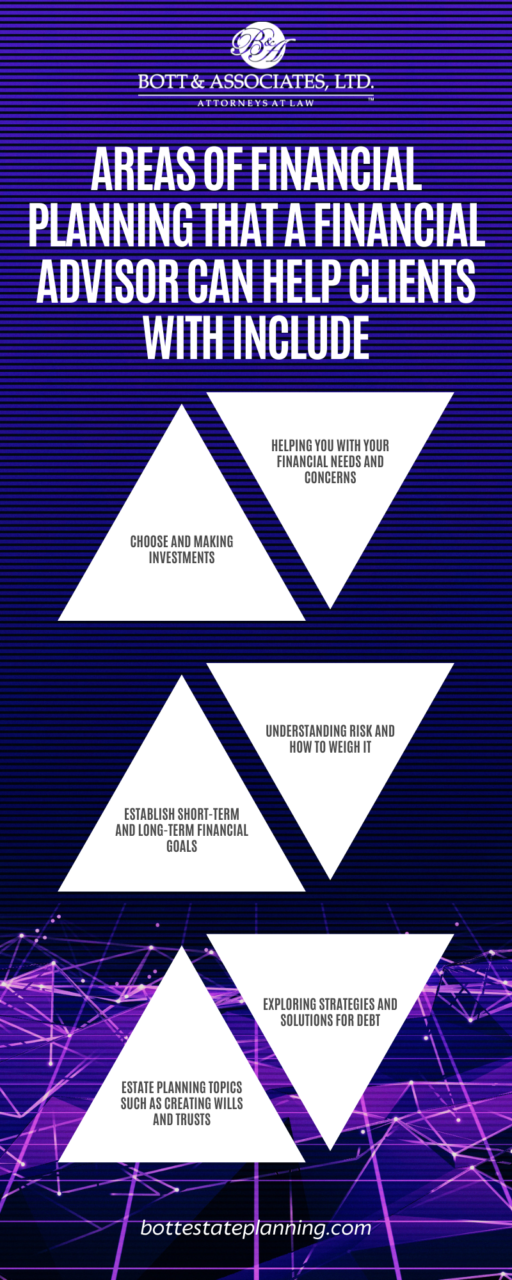

Areas Our Financial Advisor Can Help You With

Our financial advisors are here to assist you with a variety of matters, including helping you with your financial needs and concerns, helping you choose and make investments, understanding risk and how to weigh it, establishing short-term and long-term financial goals, exploring strategies and solutions for debt, and understanding estate planning topics such as creating wills and trusts.

After we’ve created a plan, we’ll work with you to continue making your plan adapt for the future. We aim to have an ongoing relationship with all of our clients and therefore they are going to give you a reminder every three years to review your plan with them.

If you need to make any necessary updates or have any questions about potential changes, we can assist you with that as well. We want to meet and make changes as your life continues to unfold and change.

Components Of A Financial Plan

Each person will have a financial plan that is specific to their particular needs and goals. For example, the financial plan of a small business owner might look different than someone with a large amount of credit card debt.

Our Schaumburg financial advisor will discuss what you are looking to gain from your plans, such as the amount of money you want to save, profits you want to earn, and more. We will ask you questions about your assets, net worth total, family obligations, medical needs, and other related topics.

When you are drafting a plan, some of the things that you might want to address include what type of accounts to establish, investments to make, loans to take out, budgeting strategies, and spending limits. Once you and your financial advisor are on the same page about your situation, you can move forward to develop a concrete plan.

Estate Planning

Anyone who understands the importance of financial planning should also embrace a proactive estate planning approach. To many, estate planning seems like nothing more than planning out how one’s existing assets will be distributed upon one’s death. Estate planning is often a vital component of financial planning.

The tax consequences of one’s estate planning approach can make or break one’s financial planning goals. The impacts of charitable giving can be influenced profoundly by the utilization of estate planning tools and resources. Proactive savings for a child’s education, the future stability of family finances, and the structure of one’s financial plan can all be profoundly influenced by estate planning.

Acting Sooner Rather Than Later

It is important to connect with our experienced Illinois finance team at Bott & Associates, Ltd. as soon as you can if you either need to construct an estate plan from scratch or need to update your existing estate planning documentation.

None of us knows how many days we will be granted before our estate plans become an urgent business for our loved ones. Don’t risk burdening your family with an incomplete estate planning vision and don’t risk the reality that if you don’t spell out your wishes clearly now, they won’t be honored later. Take the time to connect with our team about your estate and financial planning needs today.

Asset Division Concerns Pre- & Post-Divorce

The ways in which you and your spouse opt to divide your marital assets now could have a major impact on your future financial stability.

Many individuals are—very understandably—tempted to make asset division choices based on emotion. For example, you may be very concerned with retaining ownership of your marital home. There is absolutely nothing wrong with being attached to a particular asset or even with fighting for a particular asset.

However, you need to be aware of the ways in which your asset division strategy will affect your future finances before committing to that approach. Say that keeping your marital home would burden you with a level of tax liability that is unsustainable. Or, say that by choosing to sell your marital home, you’ll be able to reach a different financial goal. Our job isn’t to tell you what to do. It is to assess your situation objectively so that we can help you make whatever informed decisions fit your needs.

Protecting Your Assets

When you develop an asset protection plan, you are essentially guarding your property. If a person files a claim versus you, the process of being involved in a lawsuit may render you bankrupt. Without a plan in place, your properties could be liquidated.

Our financial advisor can assist you in creating an asset protection plan so that you can be prepared in the event of legal disputes that jeopardize your assets and property. An asset protection plan is an essential component of your financial plan as a whole.

Financial advisors can be entrusted with monitoring every element of your monetary life, from retirement planning to estate planning, savings, and also investing. A financial advisor is responsible for more than simply recommending financial investment choices or offering economic products. We can help in reducing the tax obligations you pay and also maximize the returns on any kind of economic property you might own.

Important Illinois Financial Planning Laws To Consider

In the state of Illinois, specific laws govern the activities and responsibilities of financial advisors to ensure that they provide their clients with the best possible financial advice and services. Bott & Associates, Ltd. is here to shed light on these crucial regulations that financial advisors in Illinois must adhere to.

- Licensing And Registration Requirements

To operate as a financial advisor in Illinois, professionals must comply with stringent licensing and registration requirements. The Illinois Department of Financial and Professional Regulation (IDFPR) oversees this process. Financial advisors are typically required to obtain licenses such as the Series 65 or Series 66, in addition to a state-specific license. The licenses are important because they ensure that advisors have the qualifications they need to assist clients.

- Fiduciary Duty

Financial advisors owe a fiduciary duty to all of their clients. Financial advisors are legally obligated to act in their clients’ best interests, prioritizing their financial well-being above all else. This means that advisors must provide advice and recommendations that are suitable for their clients’ financial situations and goals.

- Disclosure And Transparency

Illinois law also mandates that financial advisors provide full and transparent disclosure regarding fees, conflicts of interest, and potential risks associated with recommended investments or financial strategies. Each client has the right to understand how their advisor is paid and whether any conflicts can influence their practice.

- Anti-Fraud Regulations

There are many anti-fraud laws designed to protect clients from any practices that may be considered fraudulent. These laws prohibit advisors from making false statements, omitting important information, or engaging in any fraudulent activities that could harm their clients’ financial interests.

- Complaints And Dispute Resolution

In the event of a dispute or complaint against a financial advisor, Illinois offers a well-defined process for resolution. The IDFPR provides a platform for clients to file complaints against advisors who they believe have violated the law or acted unethically. The purpose of this is to ensure that clients have recourse in case a dispute arises.

Illinois has put in place a comprehensive regulatory framework to govern financial advisors and protect the interests of their clients. Financial advisors must meet rigorous licensing requirements, uphold fiduciary duties, and maintain transparency in their dealings. In order for clients to receive sound financial advice, compliance with the laws is essential.

Schaumburg Financial Advisor Infographic

Financial Planning Statistics

According to a 2022 survey by the National Financial Educators Council, only 40 percent of Americans have a financial plan, and the majority of Americans do not know how to create a financial plan.

Additionally, according to the 2023 Wills and Estate Planning Study by Caring.com, two out of three Americans do not have any type of estate planning document.

Less than 35 percent have some type of estate plan in place. Forty-two percent of Americans haven’t created a will due to procrastination and one out of three people without a will think they don’t have enough assets to need one.

FAQs

What does a financial advisor do?

Financial advisors are tasked with managing every aspect of your financial life, from retirement planning to estate planning to savings and investing.

A financial advisor is responsible for more than just suggesting investment choices or selling financial products. They will be present to assess your financial status and understand your financial goals and create a tailored financial plan to help achieve those goals. They can help reduce the taxes you pay and maximize the returns on any financial assets you may own.

Why should I hire a financial advisor?

If you are like most people, you have spent most of your life achieving your goals. The advice and direction of a financial advisor will be essential to implementing a plan that helps you meet your financial goals and objectives.

If you have an especially large set of assets or you are expecting to craft a more complex plan, you should not attempt to create it yourself. When you are trying to clarify and execute your finance planning goals, we will be able to help you accomplish that. There is little room for mistakes. Making a comprehensive financial plan that fits your needs and goals requires great consideration and careful planning.

To learn more about how our Schaumburg financial advisor can assist you in defining, setting, and achieving goals, Illinois-based residents often choose to contact Bott & Associates, LTD, who are experienced in helping clients with their financial questions.

How should I get started?

Financial planning is more complicated than it seems, and when you rush the process, it can cause you to make an insufficient plan that doesn’t totally address your needs. Before you commit to specific financial planning methods, consider all of your options.

If you are unsure about the pros and cons of certain methods, you should ask a skilled financial advisor for a more in-depth explanation.

Do I need an emergency fund?

A common mistake that people often make when they are organizing their finances is to forget to set up an emergency fund. Everyone should be prepared for emergencies because they can happen at any time and when it is least expected.

When it comes to saving up an emergency fund it is advised to have a fund that contains roughly three to six months’ worth of savings. The last thing that you want is for an emergency like a house repair or sudden accident to happen and you lack the funds to cover your expenses.

How often should I update my plan?

Another important point to know about a financial plan is that it must be updated regularly. You do not simply make a plan and leave it the same way. Expect your plan to fluctuate over the years as your unique goals and priorities evolve. In some years, you may be focused more on saving money, for example.

Financial plans must be updated often, such as after important life changes or events like the loss of a loved one or the birth of a new child. Frequently review your assets to ensure that they are well protected and that your financial plan is in line with the latest laws and recommended practices.

Financial Advisor Glossary

A Schaumburg, IL financial advisor often works at the intersection of financial planning and legal strategy. For clients planning for retirement, managing assets, or addressing estate matters, it’s helpful to understand some of the terminology used when meeting with an advisor or attorney. Below, we’ve compiled key terms that reflect common legal and financial planning concepts we encounter when assisting individuals and families.

Probate Administration

Probate administration refers to the court-supervised process of managing and distributing a person’s estate after they pass away. This includes validating the will, identifying assets, paying outstanding debts, and distributing property to heirs or beneficiaries. If someone dies without a will, their estate still goes through probate, but the court determines distribution based on state intestacy laws. For those looking to minimize delays and potential conflict among heirs, a financial advisor may recommend strategies such as beneficiary designations, joint ownership, or establishing a trust. In Illinois, this process can take months or even years, depending on the complexity of the estate.

Fiduciary Obligation

A fiduciary obligation is a legal duty requiring one party to act in the best interest of another. In financial planning, this duty applies to advisors who manage money, offer investment guidance, or oversee estate matters on behalf of clients. In Illinois, licensed financial advisors must follow fiduciary standards that include loyalty, care, and full disclosure of potential conflicts. This legal responsibility distinguishes fiduciaries from financial professionals who may only meet a “suitability” standard, meaning they can recommend products that are appropriate but not necessarily the most cost-effective or beneficial. Clients working with fiduciaries gain an additional layer of legal protection and ethical oversight.

Trust Administration

Trust administration begins after a trust is activated, typically following the death or incapacitation of the person who created it (the grantor). The trustee is responsible for managing the trust’s assets according to the instructions outlined in the trust document. This may involve distributing assets, maintaining property, filing tax returns, and communicating with beneficiaries. Illinois law requires that trustees act in good faith and in accordance with the terms of the trust. Working with a financial advisor and legal counsel can streamline this process and avoid common pitfalls, particularly when multiple beneficiaries or high-value assets are involved.

Asset Protection Planning

Asset protection planning involves structuring a person’s finances to reduce exposure to potential legal claims or creditors. This can be especially important for business owners, professionals, or individuals going through a divorce. Typical strategies may include the use of certain trusts, ownership arrangements, and legal entities such as LLCs. In Illinois, the law permits a variety of asset protection techniques, but they must be executed before any liability arises to be effective. A financial advisor may assist in coordinating legal and financial tools to secure property, savings, and investments against future risk.

Beneficiary Designation Review

Beneficiary designation review is the process of evaluating and updating who is named to receive assets such as life insurance proceeds, retirement accounts, or payable-on-death bank accounts. These designations override instructions in a will or trust, making regular review critical. A financial advisor helps clients align their designations with current life circumstances, such as marriage, divorce, or the birth of a child. In Illinois, improper or outdated designations can lead to unintended distributions or legal challenges. It is recommended that these be reviewed every few years or after major life events.

At Bott & Associates, Ltd., our Schaumburg financial advisor team works with clients to develop clear, tailored plans that include all essential legal and financial elements. Whether you’re updating a trust, reviewing beneficiaries, or seeking to protect your estate, we bring clarity and structure to each step.

Let’s start building your financial plan today. Contact our office to schedule a consultation and speak with someone who can help guide your next steps.

Bott & Associates, Ltd., Schaumburg Financial Advisor

3701 W Algonquin Rd #712, Rolling Meadows, IL 60008

Contact Our Financial Advisor Today

At Bott and Associates LTD, we understand the importance of building lasting relationships based on trust and transparency, and we are committed to guiding our clients towards achieving financial security and success.

Our clients’ financial well-being is our top priority, and we continually strive to exceed their expectations with our professional, client-centered approach.

Our team of attorneys and financial advisors is well-versed in Illinois financial advisory regulations and can provide you with the guidance you need to navigate this complex legal landscape. We are here to assist you in achieving your financial goals. Reach out to us today for personalized advice regarding finances.

Client Review

“Over the years I have attended Bott seminars to get the most current information. The seminars are always presented in easy to understand language ang format. Very satisfied. Look forward to future seminars when new information topics are to be covered.”

– Shyam Anturkar