Oak Brook, IL Estate Planning Lawyer

Professional Assistance With Your Estate Plan

Trust our Oak Brook, IL estate planning lawyer to help you craft a comprehensive estate plan tailored to your specific needs and goals.

Whether you’re new to the process or seeking to update an existing plan, it can be hard to know where to start. There are many legal strategies that you can deploy. Our dedicated legal team at Bott & Associates, Ltd. can help you prepare for all of your estate planning needs. Reach out today to schedule a consultation with our experienced attorney. We’ve been protecting the wealth of our clients for over 20 years, and we’re ready to do the same for you.

Table of Contents

- Professional Assistance With Your Estate Plan

- Important Steps in the Illinois Probate Process

- Important Components of Your Estate Plan

- Oak Brook Estate Planning Infographic

- Estate Planning Statistics

- FAQs

- Bott & Associates, Ltd., Oak Brook Estate Planning Attorney

- Contact Our Lawyer Today

How Our Estate Planning Attorney Can Help You

Estate planning in Illinois is not just about creating documents; it’s about crafting a comprehensive plan tailored to your unique circumstances. Our experienced estate planning attorneys have a profound understanding of Illinois estate planning laws. We leverage important estate planning tools to matches your specific needs. We assist you in developing strategies to safeguard your assets against unnecessary taxes and probate expenses. Estate planning offers the peace of mind that your loved ones will be cared for, and your legacy will be preserved according to your wishes. Your estate plan may need adjustments over time due to changes in your life or revisions to Illinois laws. Our legal team provides continuous support and updates.

With more people having a larger presence on the internet, implementing digital estate planning is essential. As more and more people are using apps and other online communication methods to manage their finances, there is a legitimate risk of being a victim from unauthorized parties who are trying to gain access into your accounts. Creating a digital estate plan allows you to cover your bases and utilize a number of legal strategies so that your entire estate plan is not only continually up to date, but protected and secured.

“But wait,” you may be thinking, “I can’t map out my digital footprint in an estate plan because it changes all the time.” This is a valid concern. Thankfully, almost all estate planning documents are meant to be “living” in nature. This means that you can update them as often as you need to as your life circumstances and preferences change. Whenever a major event in your life happens, such as the addition of a new child or loss of a family member, you can update your digital estate plan as necessary. It is one of the key benefits of having an estate plan in a digital format. Additionally, please know that our lawyer team understands how to account for the ever-changing nature of digital footprints when constructing a digital estate planning strategy.

Digital Estate Planning Considerations

Think about the number of times each day you log on to an account. Each account is likely password protected. If you were to become incapacitated or to pass away tomorrow, do you have any way of relaying how to gain access to those accounts? Who would you like to have access to them? Who would you like to prohibit from accessing them? What do you want done with the information, assets, and/or intellectual property contained on these accounts? These are the primary subject matters that digital estate planning concerns itself with. By working with our qualified lawyer that clients trust, you’ll better ensure that your online life—and anything stored on any of your devices—is handled according to your preferences later.

Preparing A Digital Estate Plan

There are several things that you need to know when you are preparing a digital estate plan. To begin preparing your plan, organize all of your digital assets and find out the value for each asset. You will need to gather the login information for each as well. Determining how to best organize your accounts can be difficult, but our estate planning attorney can help. Consult with our lawyer so that we can review your assets and see if the information is correct.

Examples of digital assets include banking accounts, retirement accounts, email accounts, social media accounts, and more. Our attorney has knowledge about digital assets and can provide you more information if you are not sure what other accounts fall under the digital asset category.

Important Steps In The Illinois Probate Process

The probate process in Illinois is a legal procedure that commences following the death of an individual, with the primary aim of settling their estate. This process is multifaceted and involves several key stages, each important for the lawful and orderly distribution of the deceased’s assets. Our estate and probate lawyer can help you simply the probate process for your loved ones.

Filing A Petition

The probate process begins when a petition is filed with a probate court in Illinois. This initial step involves submitting legal documentation to officially open the estate for probate. The petition is typically filed by an executor named in the will, or if there’s no will, by a close relative or interested party. This stage is foundational, as it marks the formal start of the estate’s administration under court supervision.

Notice To Heirs And Creditors

Once the estate is opened, the next step is to notify all potential heirs and creditors. This is an essential part of the process because it allows heirs to become aware of the proceedings and gives creditors the opportunity to make claims against the estate for any debts owed by the deceased. Proper notification means that all interested parties are informed and have the chance to assert their rights or claims in accordance with Illinois law.

Inventory And Appraisal

In this phase, a detailed inventory of the estate’s assets is compiled, and an appraisal is conducted to determine their value. This step is vital as it establishes the basis for how the estate will be managed and eventually distributed. It involves cataloging all assets, such as real estate, bank accounts, investments, personal property, and any other items of value that belonged to the deceased.

Payment Of Debts And Taxes

Before assets can be distributed to heirs, the estate must settle its outstanding debts. This includes paying any taxes owed. The executor or administrator of the estate is responsible for confirming that all legitimate creditor claims and tax obligations are satisfied. This step is important for clearing the estate of liabilities and for determining the net value of the estate available for distribution to heirs and beneficiaries.

Asset Distribution

The final stage of the probate process in Illinois is the distribution of the estate’s remaining assets. If the deceased had a valid will, the assets are distributed according to its terms. In the absence of a will, Illinois’ intestacy laws dictate how the assets are to be divided. This stage marks the conclusion of the probate process, with the estate’s assets being transferred to the rightful heirs or beneficiaries.

Each of these stages requires careful adherence to legal procedures and regulations, often necessitating the guidance of our probate attorney to maintain compliance with Illinois law. The probate process can be complicated, particularly for larger estates or when disputes arise among heirs or creditors.

Important Components Of Your Estate Plan

Estate planning in Illinois is a comprehensive legal process, designed to make sure that an individual’s assets and healthcare wishes are managed and honored according to their specific desires. This process involves a variety of legal documents and strategies, each serving a unique purpose. Our attorneys can help you finalize these important components of your estate plan.

- Last Will and Testament

This vital document outlines your specific wishes for how your assets should be distributed after your passing. It’s not just about financial assets; it can also include detailed instructions on appointing guardians for any minor children you may have, securing their care and protection.

- Trusts

These are legal structures created to hold and manage assets. Trusts can be particularly useful in Illinois estate planning for several reasons. They help in avoiding the often lengthy and public probate process, thereby maintaining privacy. Trusts can be more beneficial than wills because they provide more control over how and when your assets are distributed to beneficiaries, which can be especially beneficial for minors or those who might not manage a lump sum inheritance effectively.

- Power of Attorney

This document is important for anticipating situations where you might be unable to make decisions for yourself due to incapacitation. With a power of attorney, you designate an individual to make key decisions on your behalf. These decisions can be financial, healthcare-related, or even legal, depending on the type of power of attorney you choose.

- Healthcare Directive

Also known as a living will, this document allows you to lay out your preferences for medical treatment in scenarios where you are unable to communicate your wishes. Along with specifying treatment preferences, you can also appoint a healthcare proxy – a person entrusted to make healthcare decisions for you, based on your outlined preferences.

- Beneficiary Designations

In estate planning, it’s important to remember that not all assets go through your will. Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. These designations are important as they enable these assets to bypass the probate process, allowing for a more direct and often quicker transfer to your named beneficiaries.

- Guardianship Designations

For those with minor children, one of the most critical components of estate planning in Illinois is the appointment of a guardian. This confirms that, in your absence, your children are cared for by the person you trust most, rather than leaving the decision to the courts.

Oak Brook Estate Planning Infographic

Oak Brook Estate Planning Statistics

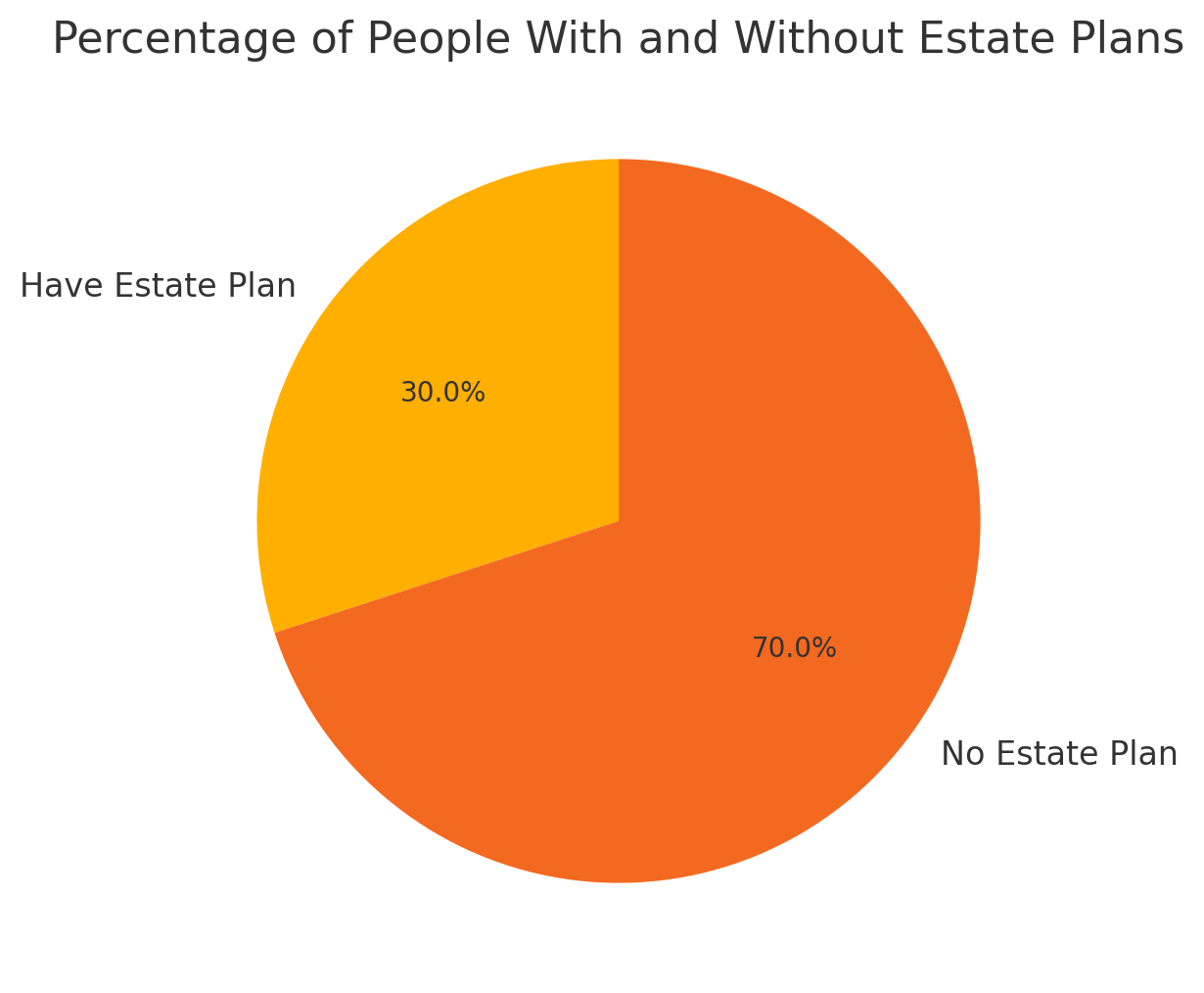

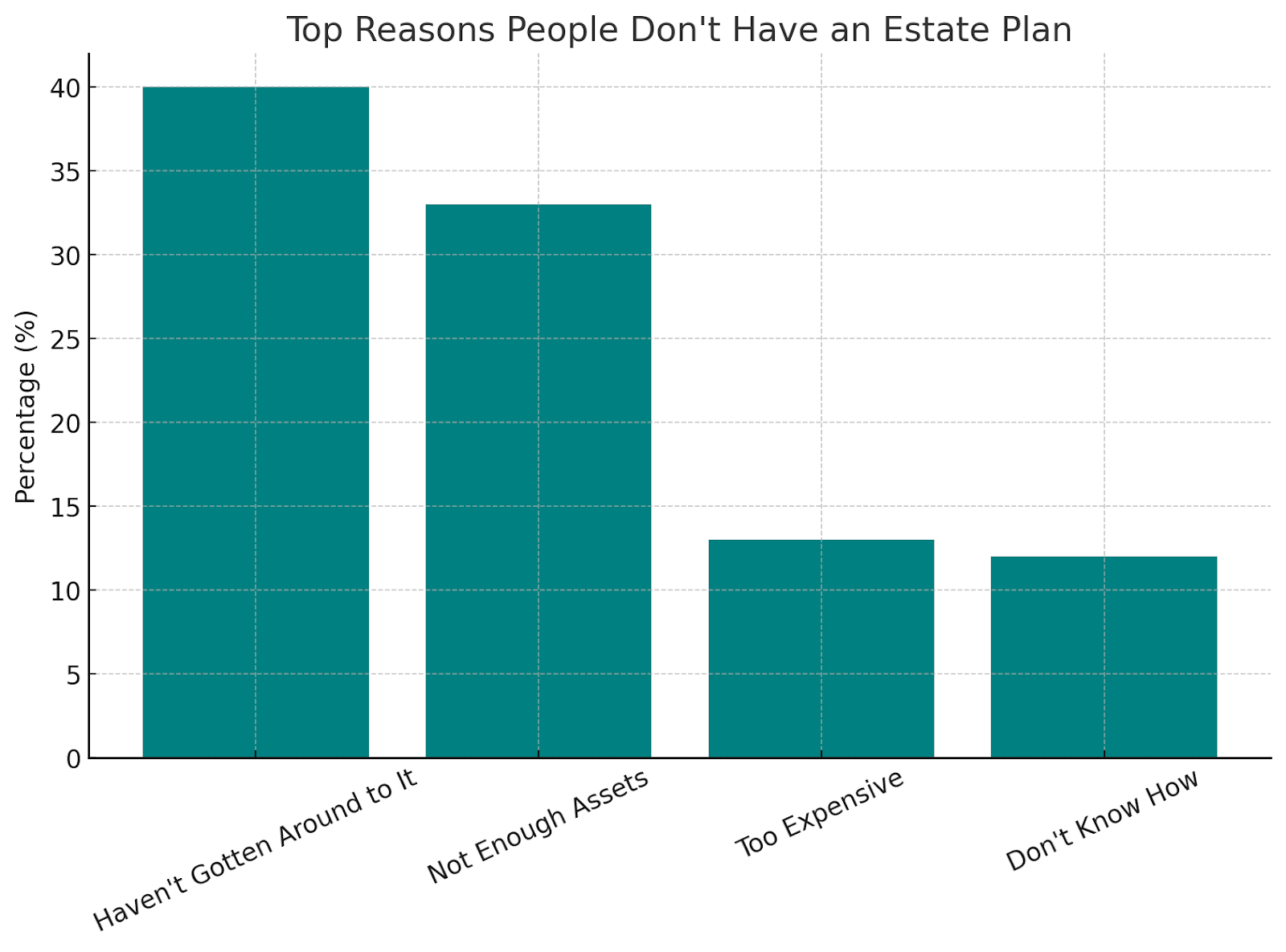

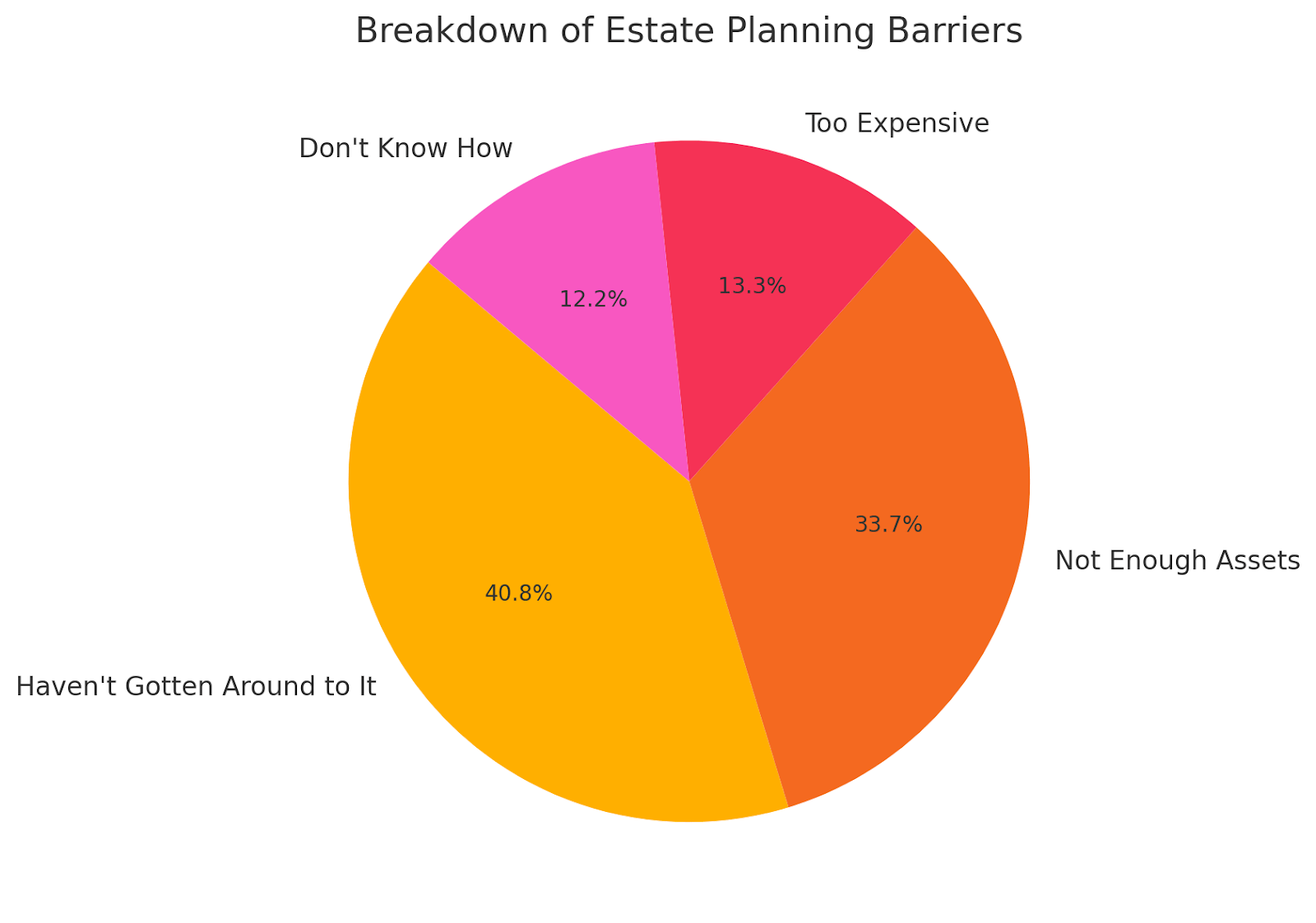

According to a survey conducted by senior living referral service Caring.com, almost 70 percent of people do not have an estate plan in place. Forty percent of people say they just haven’t gotten around to it. Thirty-three percent of people said they don’t have enough assets to pass on to their loved ones. Thirteen percent of people said putting an estate plan in place is too expensive. Twelve percent of people said they don’t know how to go about writing a will.

FAQs

Why Do I Need A Lawyer To Make An Estate Plan?

Technically, you can put together your estate plan on your own, but by doing so you would be foregoing the knowledge and experience of our trained attorney, which is not recommended. There are many strategies and tips that our lawyer can provide you with that will save you both time and money, as well as help you put together the plan that you really want, rather than just one that will work. Our lawyer will discuss your goals and wishes with you to get an idea of what your ideal options are and walk you through the entire process, making it as smooth and painless as possible.

When Should I Create My Estate Plan?

The best time to create an estate plan is now because you never know when it will be too late. Even if you know that you will need to make updates to it in the future, it is wise to get something down in writing that is legal with our estate planning attorney, just to be safe. Then, when it’s time to make changes, you can talk with our lawyer about your new needs and goals for your estate plan. Waiting too long could leave your family without the funds they will need to live and unsure of your wishes.

Is There An Income Minimum For Creating An Estate Plan?

There is no income requirement necessary to create an estate plan, and they are not just for the wealthy. No matter how much you have to leave behind, having an estate plan will help to make sure that it goes to your loved ones instead of to the state first. Our estate planning attorney will not judge your income but help you evaluate your options and walk you through plans that would be a good fit for you and your situation.

What Is A Good Amount To Leave My Kids?

When deciding what to leave to whom, there are many factors that you will want to consider, and our lawyer can explain those to you and provide advice. Some of the things that our lawyer will want to discuss with you will be the ages of your kids, how much you will have available to leave, any special circumstances or wishes you have, and more. We know that this is new for you, but our lawyer has the experience you need to come out with a plan that you’re comfortable with and that meets your goals and wishes.

How Do I Make My Estate Plan Legal?

One of the key factors in creating an estate plan is to ensure that it is filed properly and legally, which is a task that you can leave to our Oak Brook estate planning lawyer. When you work on your estate plan with our lawyer from Bott & Associates, Ltd, you will not have to worry about the details of preparing the plan so that it is legal, because that is something that we will handle for you. It will be a less stressful process for you, knowing that everything is being taken care of for you.

Oak Brook Estate Planning Glossary

At Bott & Associates, Ltd., we understand that preparing your estate plan involves several legal tools and terms that may be unfamiliar. As an Oak Brook, IL estate planning lawyer team, we aim to make these concepts clearer so you can make well-informed decisions.

Revocable Living Trust

A revocable living trust is a legal structure that allows you to place your assets into a trust during your lifetime while still maintaining control over them. You can change or revoke this type of trust at any time. It’s commonly used to help avoid probate, maintain privacy, and provide smooth asset management if you become incapacitated. Unlike a will, a trust goes into effect immediately and continues after your death, allowing your named successor trustee to manage and distribute the assets according to your instructions. This tool offers more flexibility and control than a basic will, particularly for individuals with complex asset structures or specific instructions about when and how beneficiaries receive their inheritance.

Durable Power Of Attorney

A durable power of attorney is a document that gives a trusted person the authority to act on your behalf if you are unable to do so. It remains effective even if you become mentally or physically incapacitated. There are different types, but the most common in estate planning are for finances and healthcare. A financial power of attorney lets your agent manage tasks such as paying bills, accessing bank accounts, or handling investments. This tool is critical for avoiding unnecessary court intervention, such as guardianship proceedings, should you lose the ability to manage your own affairs.

Digital Asset Inventory

Digital asset inventory refers to the complete list of your online accounts and electronically stored content that hold personal or financial value. This includes email accounts, social media profiles, online banking, cryptocurrency, and cloud-stored files. In estate planning, documenting your digital assets and providing secure access instructions helps your executor or trustee manage or close these accounts responsibly. Without this inventory, valuable information could be lost or mismanaged. This step is increasingly important as more people manage both financial and personal matters through digital platforms.

Healthcare Directive

A healthcare directive, also called an advance directive or living will, is a legal document that outlines your medical treatment preferences if you are unable to communicate. This document can include instructions on whether you want life-sustaining treatments in certain scenarios and allows you to designate a healthcare agent. This person is authorized to make decisions aligned with your values and preferences. In Illinois, having this document in place can guide your loved ones and medical professionals, minimizing uncertainty during critical times.

Probate Court Petition

A probate court petition is the legal filing required to begin the probate process in Illinois after someone passes away. This step initiates the formal administration of the deceased’s estate. If there is a will, the named executor files the petition; if there is no will, a close relative or interested party does so. The petition must be filed in the county court where the deceased resided. It triggers several additional steps, including notice to heirs, inventory of assets, and settling of debts. Filing this document starts the legal path for distributing assets under court supervision and is a core part of many estate plans when trusts are not in place.

Bott & Associates, Ltd., Oak Brook Estate Planning Attorney

3701 W Algonquin Rd #712, Rolling Meadows, IL 60008

Contact Our Lawyer Today

Estate planning is an important legal process that empowers individuals and families to make informed decisions regarding their assets, healthcare, and legacy. In Oak Brook, Illinois, understanding the details of state-specific estate planning laws is essential when preparing for the future. At Bott & Associates, Ltd., our seasoned Oak Brook estate planning lawyer is well-versed in Illinois estate planning laws, and we are here to guide you through the process.

If you reside in Oak Brook, Illinois, and need assistance with estate planning or want to review your existing plan, we encourage you to contact our firm for a confidential consultation. Our legal team has over two decades of experience in estate law. Secure your family’s future and protect your legacy by reaching out to us today.