Schaumburg, IL Estate Planning Lawyer

Estate Planning Lawyer in Schaumburg, IL

When you are ready to plan and draft your estate, it may be in your best interest to ask for help from an estate planning lawyer from Schaumburg, IL’s trusted firm, Bott & Associates, Ltd.

Estate planning is an integral part of a person’s life. No matter how simple or complex your estate might be, the assets you have worked hard to accumulate should be given to the people you wish. If you fail to draft an estate plan, there is a chance that the state will get involved and distribute your assets as they see fit.

With the guidance of an experienced estate planning lawyer from our Schaumburg, IL office, you can develop a comprehensive estate plan that meets your wishes, protects your interests and those of your beneficiaries.

Estate plans can be relatively simple, with a few documents such as a will, or complex with multiple trusts, powers of attorney, and so forth. Whatever may be included in your estate plan, your beneficiaries will not be burdened with uncertainty and financial strain.

Although planning your estate might be a complicated subject matter, you should not ignore it. The experienced estate planning lawyer that Schaumburg, IL residents trust, can provide you with a comfortable environment to begin the process.

At Bott & Associates, Ltd., we provide skillful legal support backed by years of experience. Our firm also assists those who have been named an executor and are ready to carry out the wishes of a testator, as well as anyone who may be disputing an estate. For a consultation with a knowledgeable estate planning lawyer that residents of Schaumburg, Illinois call first, call Bott & Associates, Ltd.

How We Can Help

At some point in a person’s life, you sit down and plan out what will happen to your “estate” after you have passed away. Some people don’t think they have accumulated enough wealth over their lifetime to need an official estate plan, but the reality is that everyone – no matter how much or how little they have – has an “estate.” Your estate is simply what you are leaving behind and how you want it to be distributed. While it sounds like a simple process, it could have some lofty legal consequences if not written correctly. It’s always a good idea to seek the help of an estate planning lawyer in Schaumburg, Illinois when dealing with the creation or modification of your estate plan. Here are three reasons why you need an estate planning lawyer.

Peace of mind

Having a solid, legally binding estate plan allows you to be confident knowing that your family will be taken care of after your death. You will have full confidence knowing that your children will go to the proper guardians and your property will be distributed correctly. But your estate plan contains more than just your will. It also includes assigning a power of attorney for your finances and your healthcare decisions when you cannot make sound decisions regarding both. A lawyer will ensure that all of your documents are legally binding and will stand up in court if ever contested. You can have peace of mind knowing that your wishes will be carried out as you requested after your passing.

Save Money and Time

It may seem like a contradictory statement to say you will save money by using a lawyer, but the reality is a lawyer can save you money in the long run. Estate planning lawyers generally charge a standard flat fee for their services, and once your estate plan is set up, you can move on with your life. However, if you did not use a lawyer and someone contests your will or another part of your estate plan, then your family could wind up spending thousands of dollars in court and legal fees.

Using a lawyer also saves you time. Writing up an estate plan can have its complications. You need to make sure it is properly written so that it is a legally binding document. This can be a stressful process and require a lot of research. A lawyer will do all of that research and write up the actual document for you so you can spend that time with your family.

Objectivity

Finally, a lawyer will provide objectivity when you are creating your estate plan. This process can be stressful, and different family members could be putting pressure on you to leave them certain things, but a lawyer will help you determine the best options for your estate. They will also ask questions if they feel like you are making a questionable decision (like, should you really leave your house to your cat?)

If you are thinking about creating an estate plan, reach out to a Schaumburg, Illinois estate planning lawyer today to help you get this process started.

Our Estate Planning Legal Services

For over 20 years, our firm has been guiding clients through the Illinois estate planning and administrative process. Our comprehensive services are vast and include, but are certainly not limited to:

- Trusts

- Wills

- Probate

- Estate administration

- Guardianship

- Power of attorney

- Social security planning

- Medicaid planning

- Asset preservation

- Debt planning

- Dispute litigation

Which Estate Planning Tools Should All Adults Consider?

A common misperception exists in popular culture that adults only need to draft a will or otherwise engage in estate planning if they have significant personal wealth. In reality, numerous estate planning tools become relevant the moment an individual reaches the age of 18. Certain estate planning tools become more relevant when one has children or acquires significant assets. But even unmarried young adults with little personal property and no children should strongly consider scheduling a consultation with Bott & Associates, Ltd.

As soon as young people reach the age of majority, they become legally responsible for their own decisions. As a result, they sign contracts under their own names, determine their own medical care choices, and are held accountable for their debts and assets. Until a young adult makes his or her preferences known, a court will ultimately decide who will make medical and financial decisions on that individual’s behalf if injury or illness leads to severe trauma and incapacitation. In addition, a court will determine who inherits any sentimental and/or personal property that a young adult leaves behind in the event of an early death unless that individual has specified how their valued property should be distributed. For all these reasons and more, it is essential to speak with an experienced estate planning lawyer in Schaumburg, IL, as soon as you become an adult.

Estate Planning Documents Relevant for All Adults

Numerous estate planning tools exist. Not all resources are relevant to every adult. However, some resources are applicable to all adults. The two significant categories of estate planning tools all adults should consider with care concern medical decision making and property-related interests. All individuals who wish to pass along any property of sentimental or monetary value should work with an estate planning lawyer in Schaumburg, IL, to draw up a simple will. Otherwise, the state will distribute these assets after death according to the rules of probate.

Also, all adults should work with an estate planning lawyer in Schaumburg, IL, to designate a power of attorney for medical decisions. This individual will be legally empowered to make medical decisions on behalf of the adult who made the designation if the adult has been too severely injured or made too severely ill to make decisions for himself or herself. Similarly, adults should work with an estate planning lawyer in Schaumburg, IL, to draft an advance medical directive detailing what medical treatment that individual consents to (and doesn’t consent to) if he or she becomes severely ill or injured. The terms of an advance care directive are considered first, and a power of attorney makes any decisions that fall outside the scope of the advance directive.

Estate Planning Guidance Is Available

If you have not yet made an estate plan or you have not yet taken advantage of all estate planning tools that may be beneficial for you, please consider scheduling a consultation with an experienced estate planning attorney at your earliest convenience. None of us knows when our estate plan may become urgent business. As a result, it is essential to be as prepared as possible, regardless of your age and how healthy you are. Accidents occur, individuals fall ill, and life remains unpredictable. Working with an experienced estate planning lawyer in Schaumburg, IL, will help to ensure that your wishes are both thoughtfully documented and legally enforceable so that they will be respected if and when anything ever happens to trigger the terms of your estate plan. Although the process of estate planning may be initially stressful, it will almost certainly grant you significant peace of mind once your wishes have been formally recorded.

An Overview of the Estate Planning Process with a Lawyer

Step 1 – Initial Consultation – Your estate planning process will start with a consultation with a $500 fee with an estate planning lawyer from our Schaumburg, IL office. This may be done on the phone or in person and is an excellent opportunity to get to know one another and determine what type of planning may be more practical for you and your beneficiaries.

Step 2 – Planning – Over the coming days, we will gather important information and discuss various options for managing your affairs. We’ll draft an estate plan that is a reflection of your needs, wishes, and objectives. This step may involve one or more meetings, depending on how complex your estate may be.

Step 3 – Drafting Your Estate Plan – Your estate planning lawyer will draft all the applicable legal documents.

Step 4 – Review – Once the documents have been drafted, you and your lawyer will review them together to ensure all points have been covered. We’ll also advise you of any extra steps that should be taken, such as modifying retirement benefits or insurance policies.

Step 5 – Executing the Estate Plan – We will meet you to sign or execute all documents and provide you with a copy of your new estate plan. You’ll also have the opportunity to ask any questions or get further advice.

If you are looking for premium legal advocacy for your estate planning process, look no further than Bott & Associates, Ltd. Call the estate planning lawyer that Schaumburg, IL locals trust with their futures today.

Updating Your Estate Plan: What You Need to Know

Our estate planning lawyer in Schaumburg, IL, will tell you that once an estate plan is complete, you shouldn’t leave it on the back burner until the time comes to put it into use. Know that once an estate plan is created, it should be seen as a living, breathing document and updated as changes in your life occur. Failing to do so could leave your loved ones with a useless document to rely on when carrying out your final wishes. Even if you already have an estate plan, it’s critical to update it periodically. Neglecting your estate plan could be detrimental, and in some cases, it could be entirely useless. Don’t let this happen to you, be sure to regularly update your estate plan with our team at Bott & Associates, LLC.

How Often Should an Estate Plan be Updated?

Periodically reviewing your estate plan is critical. It’s typically recommended that you check your estate plan and make changes every 3-5 years. However, know that when life changes occur, you may need to update the estate plan more frequently to ensure that it’s as accurate as possible. While it may seem like a cumbersome task, taking your estate plan out once a year and thinking over any potential changes is in your best interest. Regular review of the estate plan can ensure that your wishes are carried out in the way you intended.

When to Make Updates

Over a person’s lifetime, it’s only natural that changes in your life will occur. As these changes happen, it’s critical to make the proper updates to the estate plan. Failure to do so could result in an estate plan that is significantly out of date. Making changes gives you peace of mind and your family confidence in knowing that your affairs are in order. Here are some common situations that may trigger you to contact our estate planning lawyer in Schaumburg, Illinois, to make the proper updates:

- Divorce

- Death

- Inheritance or changes to wealth

- Birth/Adoption of children

- Guardianship updates

- Beneficiary changes

By regularly updating the estate plan, you can rest assured that everything runs as smoothly as possible. Any of the above events should trigger you to contact our team to make the proper changes. Remember that you will want to dispose of any old or out-of-date estate plans once the appropriate adjustments have been made. This can eliminate confusion for loved ones when the time comes to access these documents. Consider keeping critical records in a safe place, making those closest to you aware so that they can quickly obtain your estate plan. Our team not only offers peace of mind to clients but can also make the process of planning your estate as painless as possible.

Listen to Martiess Bott Discuss the Intricacies of Estate Planning and Divorce:

Leaving Your Child the Right Amount

When you are estate planning and want to leave your children with money, you may have one big concern: will your children spend the money wisely? If you have children you are concerned about but still wish to leave them something, there are options. In fact, many people think it is all or none but this is far from true. If you want to know the different methods for including (and excluding) a child from the will, speak with your estate planning attorney to see what your options are. Below, you’ll take a look at some of these options.

- Excluding a child. The proper term for this is also known as “disinheriting.” If you wish to intentionally exclude a child from getting money or assets, you can exclude them from the will by saying nothing. However, your attorney may recommend a more absolute statement in your estate plan since many states could view this as simply overlooking a child. If you truly do not want to include them in receiving money, it is best to write a statement into your estate plan.

- Don’t leave a lump sum. It might seem simple enough to just leave your kids each a lump sum. However, if you are concerned that they are not responsible enough to spend it wisely, you can set up a trust. This will give them specific amounts of money at certain points. You can determine how often they get the money and how much they get, whether it is annually or every five years.

- Give them incentives for getting the money. Depending on your child, this could be a way to reward your child for doing something good. For example, if you are concerned that a child may squander the money, have a certain amount released to them when they do something you would be happy about. For example, if they choose to further their education.

- Appoint a trustee. If none of the other options seem suitable to you, you can place the money in a trust and allow a trustee to make these decisions for you. You can take this opportunity to pass the baton on to someone else while still leaving them direction regarding what decisions you might make.

Making an estate plan with your children in mind can be difficult. Working with an estate planning attorney can make this process easier for you.

Schaumburg Estate Planning Statisitcs

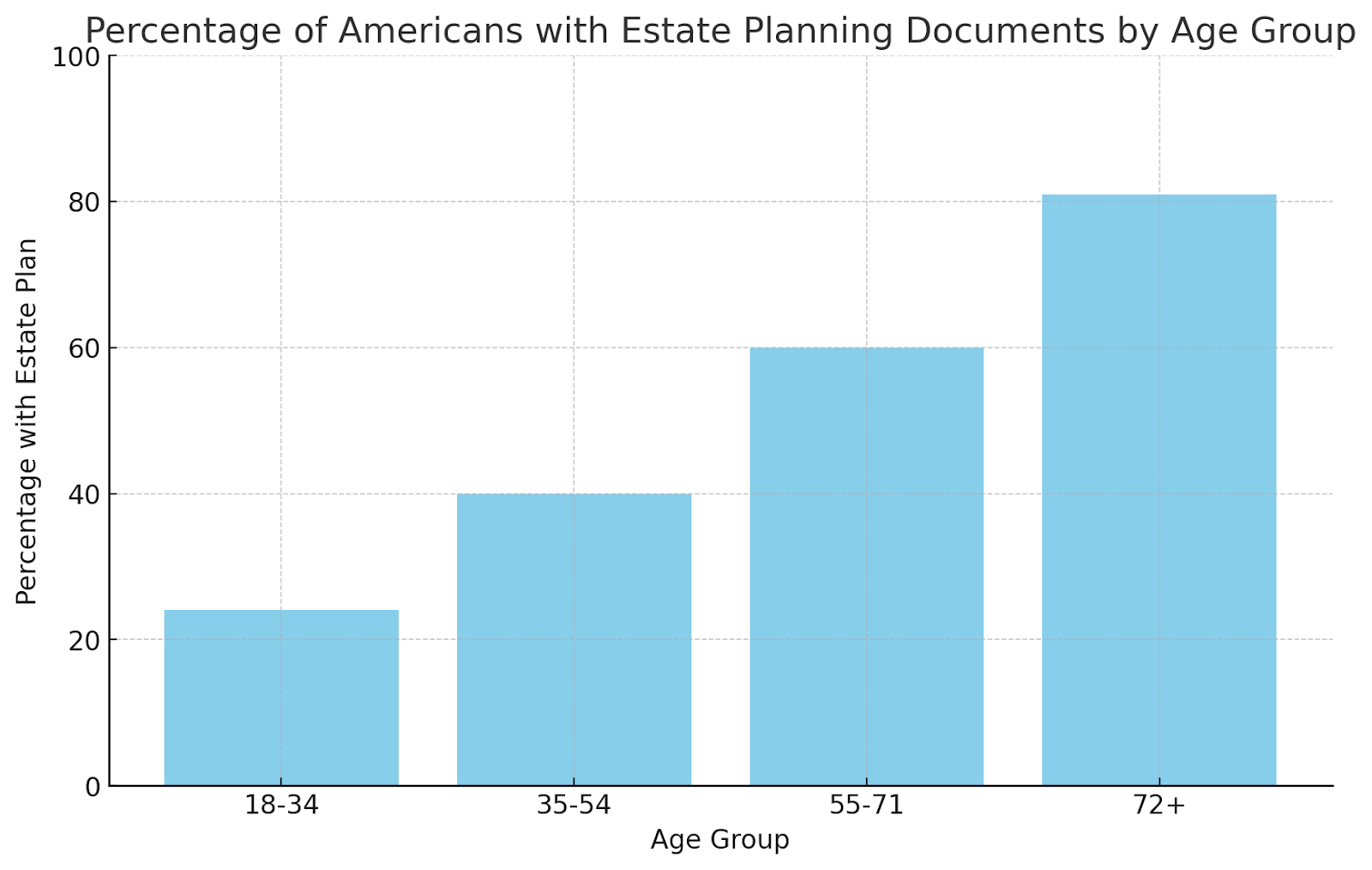

Estate planning is essential for ensuring that an individual’s assets are distributed according to their wishes after death. However, statistics reveal that many Americans fail to engage in estate planning.

According to a survey by Caring.com, more than 60% of Americans do not have any estate planning documents such as a will or living trust in place. This highlights a significant gap in planning for the future, which can leave families vulnerable to legal and financial complications after death (Caring.com).

The percentage of people with an estate plan varies widely by age group. For instance, one survey by AARP found that 81% of people aged 72 and older have a will, compared to only 24% of individuals aged 18-34. This indicates that estate planning increases with age, likely due to greater financial stability and awareness of its importance.

When individuals die without an estate plan, their assets are often distributed according to state law, potentially creating family disputes and long probate processes. Forbes reports that avoiding estate planning can lead to delays of 6 to 18 months or longer in the probate process, which can be both costly and stressful for surviving family members.

These statistics underscore the need for timely estate planning to ensure that one’s wishes are followed and to prevent unnecessary complications for loved ones.

Schaumburg, IL Estate Planning Lawyer

Drafting your own will increase the likelihood of making costly mistakes. Although the do-it-yourself, at-home alternatives may be enticing, the American Bar Association recommends hiring an Estate Planning Lawyer, or a legal professional that specializes in wills and estate planning. A qualified estate planning lawyer will be able to explain to you their interpretation of the intricacies of laws regarding property, taxes, wills, trusts, and probates. Secondly, at-home will writing kits cannot provide the personalized legal advice, the experience, and experiential knowledge base that will help those writing a will, or estate plan to feel confident about the terms and conditions in the documents.

Trusted Estate Planning Assistance

The guidance of a qualified professional will make the process easier to understand, helping to ensure that assets passing outside of your estate are handled properly, nuances of state law are considered, and other relevant tax and legal factors are resolved. A Schaumburg, IL Estate Planning Lawyer from Bott & Associates, LTD promises to make sure your legacy continues, and your property, assets, and other affairs are handled with care, taking into account nuances of local state, and federal laws as they pertain to your estate. We work to deliver peace of mind.

Proven Excellence in Estate Planning

At Bott & Associates, LTD, our team strives to provide personalized assistance with all of your estate planning related affairs. Our estate planning lawyer has been practicing law for over 20 years, and is one of only a handful of members of the American Academy of Estate Planning lawyers, in the Chicagoland area. The American Academy of Estate Planning Attorneys is a national exclusive organization dedicated to promoting excellence in estate planning.

A Personalized Approach to Estate Planning

We will assist with writing a will, or planning an estate, and will be able to explain Illinois law as it pertains to your estate, and provide advice based on our years of experience serving clients with estate planning and probate needs. Prior to creating your estate plan, contact us to schedule a consultation for a $500 fee. We will evaluate your situation and offer helpful suggestions about next steps and the most viable course of action based on your specific needs. At Bott & Associates we aim to treat every single client as part of our family.

Prepare for the future

Our estate planning services are not limited to writing your will. Our team can also help with creation of other estate-related legal documents as well, documents such as living trusts, or coming up with a plan for asset protection plans for your beneficiaries. Our team can also help with health care directives, to be implemented in the event you become incapacitated and are unable to make decisions on your own.

Estate Planning Lawyer in Schaumburg, IL

One of the reasons why it is so important to connect with an estate planning lawyer in Schaumburg, IL who is trustworthy, capable, and whose approach to representation meets your needs is that estate planning is not a “one and done” process. You’ll need to revisit your estate plan multiple times over the span of you life in order to better ensure that when your loved ones need to reference it, your estate plan accurately reflects your most current wishes.

Revisiting Your Estate Plan Once It Has Been Created

Generally speaking, you should revisit your estate plan any time a significant life event, change in preferences, or change in your needs affects the accuracy and/or scope of your estate plan. For example, you will likely need to update your estate plan in the event that any of your beneficiaries pass away and in the event that a new beneficiary is born, adopted, or otherwise makes themselves known in your life. Additionally, you may need to revisit your plan in the wake of securing significant new assets.

It is not enough to simply cross terms out and initial them on your own. You’ll need to speak with one of our attorneys about how state law will affect the ways in which you opt to update your estate plan. Otherwise, your loved ones could discover that your efforts were not legally binding. This reality can lead to a whole host of potentially negative stresses and consequences.

Estate Planning Glossary

We believe that a well-rounded understanding of estate planning is essential for clients who want to protect their future and their loved ones. Our Schaumburg, IL estate planning lawyer works with individuals and families to address key aspects of estate management, including various legal documents and processes involved in planning for the future. Below, we have provided a glossary of essential terms to help our clients gain a clearer understanding of these important tools in estate planning.

Power Of Attorney (POA)

A Power of Attorney, commonly abbreviated as POA, is a legal document that grants one person (the “principal”) the ability to appoint another person (the “agent” or “attorney-in-fact”) to act on their behalf in certain matters. This authority can apply to various areas, such as financial transactions, healthcare decisions, or property management. By designating an agent, the principal ensures that someone they trust can handle their affairs if they’re ever unable to make decisions on their own. A POA can be tailored to focus on specific areas, like managing bank accounts or making healthcare decisions, which makes it a flexible and crucial component of estate planning. The scope and duration of a POA vary depending on individual needs and preferences, with some POAs ending upon the principal’s incapacitation and others, like durable POAs, remaining in effect.

Probate

Probate is the legal process that governs the distribution of a deceased person’s estate. During probate, a court oversees the validation of the will, appoints an executor, and ensures the estate’s debts are settled before assets are distributed to heirs or beneficiaries. The probate process can involve a series of steps, including filing the will, identifying and inventorying the deceased’s property, appraising assets, and paying any taxes or debts owed by the estate. If the individual had a will, probate serves as a means to uphold the person’s final wishes, distributing their assets according to the document’s instructions. In cases where no will exists, the court steps in to distribute assets according to Illinois state law. While probate can be beneficial for overseeing asset distribution, some people prefer to bypass it through mechanisms like living trusts, which can save time and maintain privacy.

Executor

An executor plays a key role in managing the estate of a deceased individual. Appointed in the will, this person is responsible for carrying out the instructions laid out by the deceased. Executors are tasked with a range of responsibilities, including managing and safeguarding assets, paying outstanding debts and expenses, filing necessary tax returns, and distributing the estate to beneficiaries as directed by the will. Serving as an executor requires a great deal of trust, as they are expected to act in the estate’s best interest. Family members and close friends often serve in this role, though professionals can also be designated if more objective management is desired. Executors must often go through deadlines, court filings, and asset management, making the position one of responsibility and care.

Living Trust

A living trust is a useful tool for estate planning that enables an individual, known as the grantor, to transfer assets into a trust during their lifetime. By doing so, the grantor often names themselves as the trustee, retaining control over these assets. Living trusts are usually revocable, allowing the grantor to make changes or dissolve the trust entirely. Upon the grantor’s death or incapacity, a successor trustee steps in to manage or distribute the assets according to the trust’s instructions. A primary benefit of a living trust is that it can bypass the probate process, making asset transfer to beneficiaries quicker and more private. This is especially helpful for individuals who wish to streamline the process for their loved ones. Living trusts can also allow for specific provisions to be set up for family members or other beneficiaries, making them versatile in addressing unique family dynamics or specific intentions.

Advance Medical Directive

An advance medical directive, sometimes called a “living will,” provides individuals with a way to outline their medical preferences if they ever become incapacitated. This legal document can cover specific instructions about medical treatments they do or do not want to receive. It can also appoint a healthcare proxy—someone authorized to make medical decisions on their behalf if they’re unable to communicate. By outlining these choices in advance, individuals give guidance to both medical professionals and their families, helping avoid uncertainty during medical crises. Advance medical directives ensure that one’s healthcare decisions align with personal values and wishes, offering peace of mind that decisions will reflect their intentions.

Informed decision-making is a cornerstone of effective estate planning, and understanding these terms can empower you to make the best choices for yourself and your loved ones. At Bott & Associates, Ltd., we’re here to provide guidance, whether you’re just beginning your planning or looking to update existing arrangements. Reach out to our team today to discuss how we can help secure a smooth future for you and your family.

Legal Assistance Is Available

If your estate plan is in need of updates, do not panic. Simply connect with our office in order to set up a meeting with the experienced Illinois legal team at Bott & Associates, Ltd. Our lawyers and support staff have decades of combined experience representing the interests of those with estate planning needs. Therefore, we understand that navigating this particular legal need can be anxiety-inducing for some people. Please trust that we will do all that we can to ensure that your estate planning creation and update needs are taken care of in ways that are as efficient, compassionate, and respectful as possible. We look forward to speaking with you about your estate planning needs.

If you are like most people, you have spent most of your lifetime achieving your goals. The advice and direction of our estate planning lawyer will be essential to implementing an estate plan that handles your assets according to your wishes and meets all other estate related objectives. To learn more about how our Schaumburg, IL Estate Planning Lawyer can assist you, Illinois based residents often choose to contact Bott & Associates LTD, who are experienced in helping clients with their estate planning needs. Contact Bott & Associates LTD to request a consultation with a $500 fee today.

Have you been putting off the process of developing your estate plan? Or, perhaps you have an out-of-date estate plan that needs to be rectified. If so, our experienced team from Bott & Associates, LTD is available to assist you in planning for the future. We know that the process of developing your lasting wishes can be daunting and even cumbersome but, with our assistance, you painlessly complete your estate plan. Don’t delay or put your family at risk; begin mapping out your future with our experienced Schaumburg, IL estate planning lawyer as soon as possible.