Barrington, IL Estate Planning Lawyer

Your Dedicated Estate Planning Attorney

Our Barrington, Illinois estate planning lawyer can assist you with securing your legacy in a way that reflects your final wishes. In addition to specifying the distribution of your assets and other property, you can express your intentions and wishes for the loved ones you leave behind. Our lawyer can also help you put safeguards in place should you become incapacitated before passing away. Allow us to assist you and your family with your estate planning needs. Contact Bott & Associates, Ltd. today to schedule a consultation with our legal team that has over twenty years of experience managing estate law matters.

Table Of Contents

- Your Dedicated Estate Planning Attorney

- What Makes A Will Valid?

- Important Considerations When Cancelling A Will

- Barrington Estate Planning Infographic

- Barrington Estate Planning Statistics

- Estate Planning FAQs

- Contact Our Firm Today

Why Planning Your Estate Is Important

Planning your estate is not limited to focusing on who will inherit your assets. A comprehensive estate plan created with the help of our experienced Barrington estate planning lawyers from Bott & Associates, Ltd. will include other essential directives. For instance, it may consist of medical treatment instructions should you experience a critical health issue that prevents you from making important decisions independently. Our attorney can also help you and your heirs avoid paying unnecessary taxes. We will be there for you when updates to your estate plan are necessary following life events that necessitate changes.

Illinois Estate Planning Laws

Estate planning in Illinois is governed by a set of laws and regulations designed to help individuals plan for the distribution of their assets upon their passing. The primary goal of estate planning is to protect your wealth and confirm that your loved ones are provided for in the way you intend. In Illinois, the key legal documents for estate planning include wills, trusts, powers of attorney, and healthcare directives. You can count on our lawyers to have the skills to effectively create and manage your estate plan. We are well-versed in the facets of Illinois estate planning laws, and we are here to guide you through the process and help you avoid common estate planning mistakes.

Wills And Trusts

A Last Will and Testament is a legal document that outlines how your assets should be distributed after your death. It also allows you to appoint guardians for minor children and specify your funeral and burial wishes. Trusts are legal entities that offer individuals ways to conveniently manage their assets. Illinois law allows for various types of trusts, such as revocable living trusts, irrevocable trusts, and special needs trusts, each serving different purposes in estate planning.

Powers Of Attorney

Illinois recognizes powers of attorney, which grant someone you trust the authority to make financial or healthcare decisions on your behalf if you become incapacitated. Financial power of attorney and healthcare power of attorney can be critical documents to understand. These documents are essential for making sure that your affairs are managed according to your preferences, even if you are unable to do so yourself.

Probate And Estate Taxes

Probate can be complicated, and is often a process many people try to avoid. Probate is the legal process of validating a will, settling debts, and distributing assets after a person’s death. Illinois has specific laws governing this process, and it can be challenging and time-consuming. Estate taxes can also apply to estates of a certain size, and knowing how to minimize these tax implications is vital for preserving your wealth.

The Risks Of Not Planning Your Estate

The absence of an estate plan can cause a ripple effect of issues ranging from confusion, stress, and angst amongst heirs to courtroom litigation and the reality that your final wishes may not be honored. In short, not having an estate plan can be costly for you and your loved ones in terms of taxes and the emotional toll. Even close families can enter into turmoil when loved ones are left to wonder what the deceased wanted for burial plans, asset distribution, and final thoughts. These disagreements have the potential to last forever and splinter families. Our skilled estate planning attorney can help you and your family avoid these scenarios by creating a robust estate plan.

What Makes A Will Valid?

A will may not be considered valid unless it includes the following:

- The will is in writing and is signed by the testator or another person in their presence and by their direction.

- The testator intended, with their signature, to give effect to the will.

- The signature was made in the presence of another witness.

- The witness attested to and signed the will or acknowledged the testator’s signature.

If the above was not complied with, the estate might be disputed and/or distributed according to intestacy laws.

The Signature Page

Any mark made on the will by the testator could validate it as long as that was the intention. The signature page of the will is considered to be an accurate reflection of how the testator should sign the will. A few scenarios may hold true and warrant the need for the signature page to be slightly altered.

- If the testator cannot read, the signature page should state that it was read to them.

- If the testator could not sign the will, someone else can do so on their behalf. This should be stated on the signature page.

- If the testator signs the will but struggles to do so clearly, the page can state that the testator will make a mark, and the mark will act as the signature.

A date is not necessary. However, our estate litigation lawyer would recommend that it is included. This helps to avoid any doubt regarding whether it is the latest will.

A will is considered the last statement of a person and sets out how they would like their estate to be distributed after they die. After a will has been drafted, it will not be considered legal until signed. There is a correct way to sign a will. If it is not signed correctly, it may be considered invalid. If this should happen, several issues could arise, and lead you to needing our estate litigation lawyer.

Requirements Of A Witness

In general, two witnesses are required during the signing of a will. They should also possess characteristics including:

- The witness should be over 18.

- They cannot be blind.

- They should be traceable.

- They must have a sound understanding of what they are doing.

Witnesses don’t have to be in a specific profession or need any certifications or qualifications. Many witnesses are good friends, neighbors, work colleagues, or family members. It is also possible to have a notary witness or lawyer act as a witness for a will.

Important Considerations When Cancelling A Will

If you are wondering whether or not a will can be canceled, in short, yes, it can be; however, there is a right and a wrong way to go about it. If you would like to cancel a will, you should understand how to do so to secure the correct administration of your estate after you die. Generally speaking, you may revoke a will by utilizing one of the following methods:

Revoking A Will In Writing

If you would like to cancel your will, you can draw a written document that expresses this desire. In general, this method is only done when a new will is drafted, and included in this new document should be a statement noting the old will has been canceled. Our estate planning attorney, will make sure this is done correctly so there is no confusion or potential of a will challenge.

Physically Destroying The Will

It is possible to physically destroy the will by tearing, burning, or otherwise ruining the document. For this act to be valid, you, the drafter of the will, must intend to cancel it by the physical act.

Lawful Operation

Under the law, certain occurrences could cause a will to be canceled. These events may include but are not limited to a marriage, divorce, and the birth of a child.

One of the most critical elements that must be considered when canceling a will is the actual intention or desire to cancel it. If a will’s creator has not mentioned their wish or intention to revoke the will, and later after their death, it is discovered that a will has been destroyed, there could be grounds for a dispute. In this case, you would likely need to retain our legal team, who understands litigation.

Determining Whether Or Not You Should Cancel

Sometimes it may be necessary to revoke a will. Examples may include the birth or death of an immediate family member, relative, or friend who may be a named beneficiary or will likely be a named beneficiary, the acquisition of property or a large amount of money, the acquisition of a large debt, a change in marital status, or a relocation out of the country.

In general, anyone with a will can revoke it if they believe life changes will affect provisions. However, it is often easier to create a new will rather than make amendments to a current one. You may want to consider talking with our lawyer to determine whether you should add an amendment or make a new will. The same advice applies if you are thinking about canceling a current will.

Barrington Estate Planning Infographic

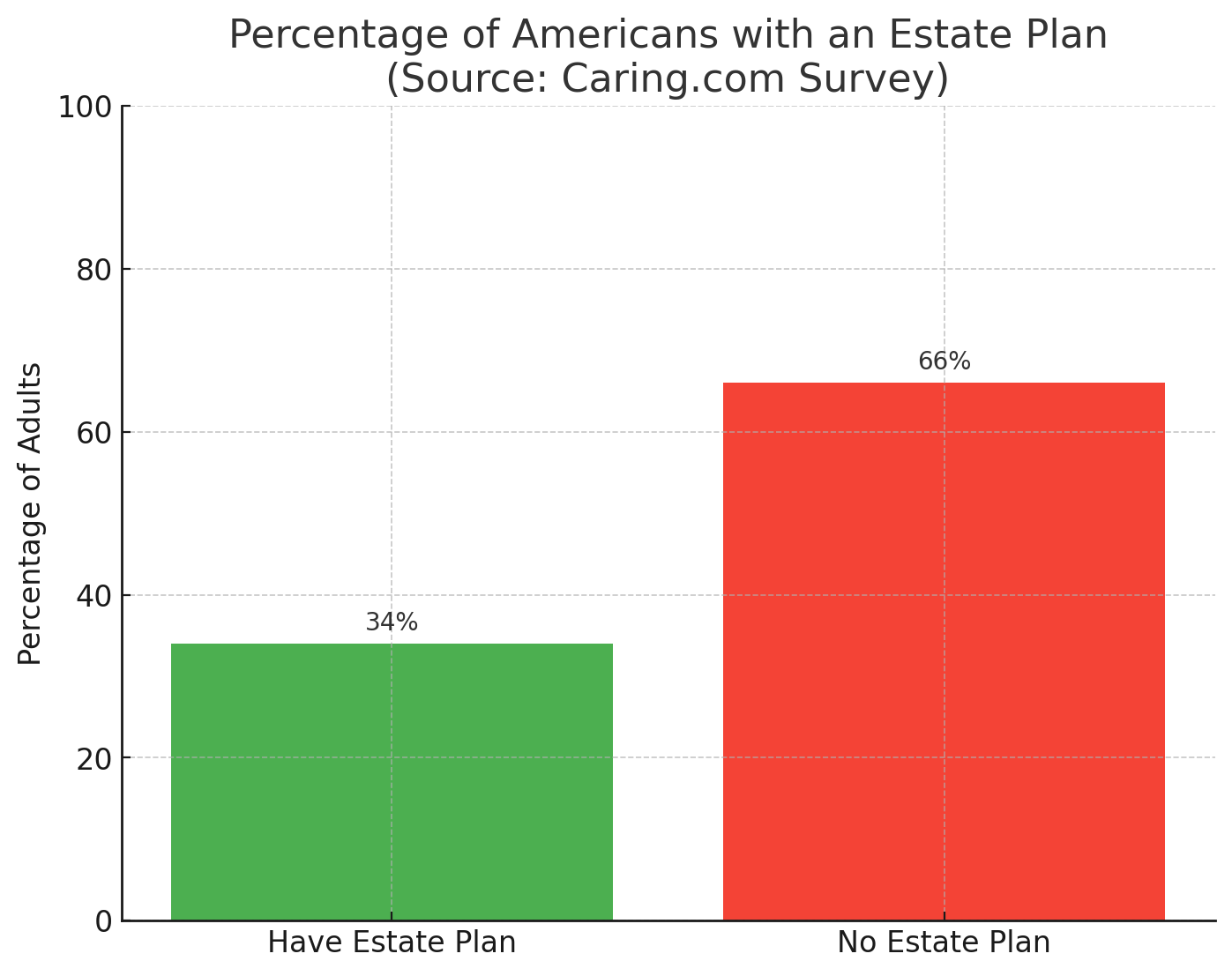

Barrington Estate Planning Statistics

Estate planning is important, but according to a caring.com survey, only 34% of Americans have an estate plan. This means that the vast majority of Americans do not have a plan in place for how their assets will be distributed after death. Some people may not think they need an estate plan because they don’t have a lot of assets, while others may be afraid of the cost or simply don’t know where to start.

However, having an estate plan is important for everyone, regardless of your age or financial situation. An estate plan can help to make sure that your wishes are carried out after death, and it can also help to protect your family from unnecessary conflict.

Barrington Estate Planning FAQs

Our estate planning attorney can help people who need to develop an estate plan or need assistance with updating an already existing estate plan. The estate planning process isn’t just a tool reserved for the wealthy. It outlines important life decisions that your loved ones will need if you cannot make decisions independently. Estate planning can seem overwhelming and complicated, however, with the assistance of a firm like Bott & Associates, LTD, you can make the process as straightforward as possible.

What Is Probate?

Probate is the process of validating the will in court, ensuring that debts and taxes are paid, the executor is appointed, and the estate is resolved. Many people are looking to avoid probate because it can be costly, time-consuming, and becomes a public record. Probate is a requirement. However, it’s possible to minimize the number of assets that must pass through probate with the proper strategies.

Can You Make An Estate Plan Without A Lawyer?

Some people consider drafting their estate plan themselves to save money. While there are many do-it-yourself estate planning forms available online, it may not be in your best interest to use them. Estate planning laws can differ by state, and these online forms do not always take state specific laws into account. If you draft your estate plan on your own, it might not be valid in court. That is why it is worth spending the extra money on hiring our experienced planning lawyer. We will help you draft a valid estate plan that will stand up in court. This will give you peace of mind.

Do Young People Need An Estate Plan?

It is still commonly assumed that younger people can wait until they are older to establish an estate plan. However, it is actually never too early to start your estate plan. Even if you’re young, you just never know if the unexpected will happen. You want to make sure that your property goes to the right people. Establishing a proper estate plan will help you do that. Additionally, if you have children or pets, you can appoint a guardian for them in your plan.

Who Should I Select As The Executor Of My Will?

An executor is responsible for paying your creditors, enforcing your final wishes, and distributing assets to the proper beneficiaries. Since the job is such a big responsibility, you should not choose just anyone for the job. Your executor should be organized, trustworthy, communicative, financially savvy and impartial. If you cannot find someone in your family to fulfill the role, you may consider hiring a third-party, such as our lawyer to complete the job.

What Plans Can I Make For My Pets?

If you have pets, you of course want them to be taken care of if you should die suddenly. Luckily, you can provide for your pets in a will. You can appoint the person you want to take care of your pet and leave money for their care. You can also list instructions about how to properly take care of your pets. For example, if your dog requires a special food for allergies or must take medication every day, you should write that down in your will.

How Can A Trust Enhance My Estate Plan?

Developing a trust can offer several benefits. While a person can choose several types of trusts, a trust is broadly described as transferring assets from the owner to a trustee, who will manage these assets. Living trusts can be developed and managed while a person is still alive. In some cases, the grantor (the person who puts assets into the trust) can also be the party responsible for managing these assets until they pass away. A trust can offer several advantages, including protecting assets, keeping assets private, allowing assets within the trust to avoid probate, including specific instructions for how and when assets are distributed, reducing estate taxes, and more.

Estate Planning Glossary

If you’re looking for help with wills, trusts, or probate matters, working with our Barrington estate planning lawyer gives you clarity on legal processes that directly affect your family and your future. This glossary is designed to explain important terms that may come up when you’re working with an attorney on matters like asset distribution, incapacity planning, or establishing protection for loved ones. Each entry below includes a plain-language explanation of key legal phrases often used in estate planning discussions, especially in Illinois.

Revocable Living Trust

A revocable living trust is a legal tool used to manage and distribute a person’s assets during their lifetime and after death. Unlike a will, this type of trust allows the person (known as the grantor) to maintain control over the assets while they are alive and mentally capable. The term “revocable” means the grantor can amend or cancel the trust at any time before death. Once the grantor passes away, the trust becomes irrevocable, and the assets are distributed according to its terms, without the need for probate. This document is commonly used to reduce delays in distributing property and to maintain privacy.

Power Of Attorney For Property

A power of attorney for property is a legal document that authorizes someone else—known as the agent—to handle financial and property-related decisions on your behalf. In estate planning, this tool is used in the event the person granting authority becomes unable to manage their financial matters due to illness or incapacity. The agent may have access to bank accounts, the ability to pay bills, manage investments, and even sell property, depending on the scope granted. This document can take effect immediately or only upon the onset of incapacity, depending on how it’s written.

Pour-Over Will

A pour-over will is a type of will used in conjunction with a revocable living trust. Its primary function is to direct any remaining assets not already titled in the name of the trust to “pour over” into the trust after the person’s death. This ensures that all property, even if overlooked or acquired shortly before death, is still distributed under the terms of the trust. It serves as a backup to the trust, helping to avoid partial intestacy and simplifying asset transfers. While it does require probate, it ties the estate together under a unified plan.

Healthcare Power Of Attorney

A healthcare power of attorney allows an individual to appoint another person—called a healthcare agent—to make medical decisions on their behalf if they are unable to do so. This includes decisions about treatments, procedures, and end-of-life care. The document is essential in cases of serious illness or injury that render someone unconscious or incapable of communicating. It’s different from a living will, which outlines specific treatment preferences. In Illinois, this document is legally recognized and often part of a broader estate planning strategy to protect personal wishes in medical situations.

Probate Court Proceedings

Probate court proceedings refer to the legal process through which a deceased person’s estate is administered. When someone passes away with or without a will, their estate often goes through probate to resolve debts and distribute property. If the person left a valid will, the court supervises its execution. If no will exists, Illinois intestacy laws determine who inherits the estate. The process can involve court filings, public notices, appraisals, and creditor claims. While probate is standard, it can be time-consuming and costly, which is why many people use trusts to avoid or limit it.

Working with an experienced attorney can help make estate planning less stressful and more efficient. If you’re considering putting together a trust, will, or any other legal directive in Illinois, we recommend consulting Bott & Associates, Ltd. for professional guidance tailored to your personal goals.

Ready to take the next step in securing your estate plan? Contact our team today to get started with a strategy that fits your needs and gives you peace of mind.

Contact Our Firm Today

If you’re seeking an experienced estate planning lawyer in Barrington, Illinois, look no further than Bott & Associates, Ltd. Our team of women lawyers possess in-depth knowledge of Illinois estate planning laws. We stand by a commitment to personalized service and can help you protect your assets and provide for your loved ones. Don’t leave your future to chance—contact us today to schedule a consultation and take the first step toward securing your estate and peace of mind. Connect with our Barrington estate planning attorney to learn more about how you can accomplish your estate planning goals.

Client Review

“Over the years I have attended Bott seminars to get the most current information. The seminars are always presented in easy to understand language ang format. Very satisfied. Look forward to future seminars when new information topics are to be covered.”

Shyam Anturkar